When buying a home, one of the most important early financial decisions is determining the amount of your down payment. In Canada, it’s legally possible to purchase a home with as little as a 5% down payment—but this strategy comes with hidden costs, such as mandatory mortgage loan insurance. On the other hand, making a down payment of at least 20% allows you to avoid this insurance and significantly reduce your total mortgage cost.

What Is a Down Payment?

A down payment is the amount of money you invest upfront when buying your property. The remaining balance is financed by your mortgage. In Canada, the minimum required down payment is:

-

5% for properties under $500,000

-

10% on the portion above $500,000 (up to $999,999)

-

20% minimum for homes priced at $1 million or more (mandatory)

But beyond meeting the legal threshold, the down payment directly impacts the overall cost of your home purchase.

Why a Down Payment Between 5% and 19.99% Triggers a Premium

If your down payment is less than 20%, your mortgage is considered high-ratio, which means you are required to purchase mortgage loan insurance. This coverage is typically provided by the Canada Mortgage and Housing Corporation (CMHC), Sagen, or Canada Guaranty. It protects the lender (not you) in the event of a loan default.

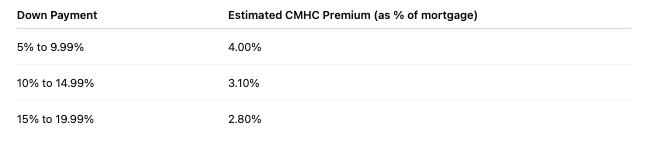

The cost of this premium depends on the loan-to-value (LTV) ratio, which is the percentage of the home price financed by your mortgage. The lower your down payment, the higher your premium:

On a $400,000 home with a 5% down payment ($20,000), the CMHC premium would be approximately $15,200, which is added to your mortgage.

This is the most immediate benefit. By putting down 20% or more, your mortgage is conventional, meaning no insurance premium is required. This can save you several thousand dollars upfront.

A larger down payment reduces your total mortgage balance, which in turn lowers the total interest you’ll pay over the life of the loan.

A lower LTV ratio makes your mortgage application less risky to lenders. This can help speed up approval and make you more competitive—especially if your income is variable or your credit history isn’t perfect.

Some lenders offer preferential interest rates on conventional (non-insured) mortgages because the risk is lower for them.

Not necessarily. In some cases, buying with a smaller down payment may make sense, especially if:

-

You want to enter the market quickly in a rapidly rising market

-

You’d rather keep more liquid savings for emergencies or other investments

-

You qualify for first-time homebuyer assistance programs, which help supplement your down payment

Still, it’s crucial to understand the long-term cost implications and be prepared for higher upfront and monthly costs if your down payment is under 20%.

Use automatic monthly transfers to build your down payment over time in a high-interest savings account.

Use your RRSP savings through the Home Buyers’ Plan (HBP) to withdraw up to $60,000 tax-free. Your Tax-Free Savings Account (TFSA) is also a great tool for growing your down payment without taxes on earnings.

- First-Time Home Buyer Incentive (FTHBI): A federal shared equity mortgage offering 5–10% of the home’s value as a no-interest loan

- Home Buyers’ Tax Credit (HBTC): Provides up to $1,500 in tax relief

Buying later may allow you to save more, avoid CMHC insurance, and negotiate from a stronger financial position.

Putting 20% or more down on a home is a powerful financial advantage. Not only do you save on mortgage loan insurance, but you also reduce your debt, your interest payments, and potentially unlock better loan terms. While it may require more time and discipline to reach this level of savings, the long-term benefits are often well worth the effort.