Write your awesome label here.

capital game

Québec Pension Plan (QPP): When and Why to Start Your Pension

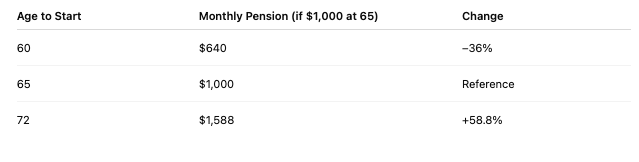

The Québec Pension Plan (QPP) is a key part of retirement planning for Quebec workers. While you can begin receiving benefits as early as age 60, the timing of your application significantly impacts how much you'll receive — for life.

What Is the Québec Pension Plan?

The QPP is a mandatory public pension program funded by payroll contributions from both employees and employers.

Starting the QPP at Age 60: A Permanent Reduction

You may choose to begin receiving your QPP retirement benefits as early as age 60. However, this comes with a permanent reduction to your monthly payments.

When might this make sense?

Delaying Past 65: A Long-Term Gain

When is this strategy advantageous?

Simplified Comparison